Years ago, when I took undergraduate economics, we were taught that as a person’s income increases, their savings increase as a percentage of their income. The rationale is that wealthier people would rein in their consumption as their incomes rose. No doubt there more than a few Republican, supply-side boosters who parroted the line to justify why it was fine and dandy for the rich to get so much richer than everyone else.

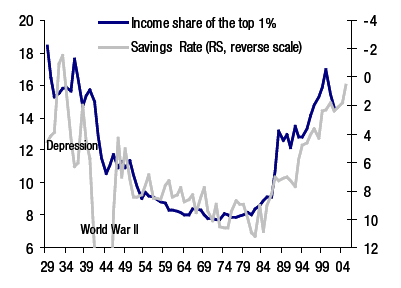

Reality hasn’t been so accommodating to that line of thought, what with the fall in the savings rate as income inequality went through the roof. However, i didn’t have good figures until this post by Yves Smith of Naked Capitalism. Her graphs (which she gets from a Citigroup report on Plutonomy, and why it is a good thing) sum things up nicely:

That is savings rate on the right and share of income claimed by the top 1%.

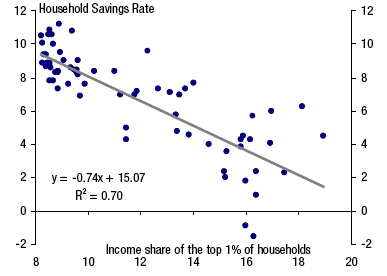

Here is the same data as a scatter plot showing the relationship even better.

Certainly, correlation does not equal causation, but falls in the savings rate seems to lag behind rises in the share of income claimed by the top 1%. I cannot think of a way that falls in savings rates would trigger a rise in the income of the top 1%. However, as Yves says:

“If you are rich, you can afford to spend all your income. You don’t need

to save, because your existing wealth provides you with a more than

sufficient cushion.”

To simplify things, many folks who are poor don’t have the income to save. Folks in the middle class have more of an ability to save and see saving for retirement as possible and so do. The rich don’t need to save. There is a status incentive for the middle class to spend beyond their means and emulate “their betters.” Of course, incomes have shrunk for everyone who isn’t in the top 90%, so perhaps folks are spending to keep the status quo.

One interesting result of this condition is that as the savings rate decreases, we need to borrow more from other countries, assuming investment and government deficits are stable as a percentage of income. Or perhaps investment could fall, leading to a future dismal economy.

On possible solution is to tax the rich and reduce the federal government’s deficit or even create a surplus. After all, if the rich aren’t willing to save, there is no reason we cannot have the federal government do it for us. Indeed, reversing Bush the Lessor’s tax cuts and cutting military spending would go a long way to balancing the federal government’s budget as Doug Henwood pointed out in a recent issue of the Left Business Observer.

[Yes, the title is semi-recycled.]